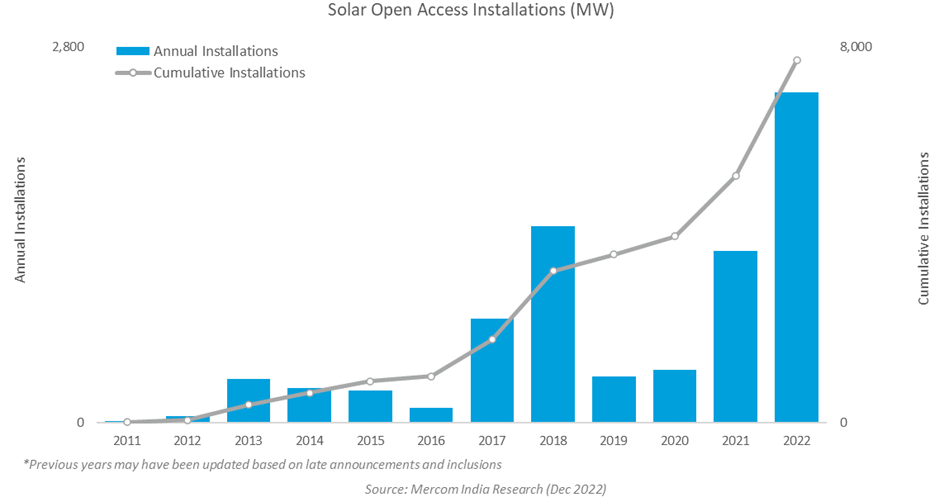

March 15, 2022 – Bengaluru, India – In calendar (CY) 2022, India added 2.5 gigawatts (GW) of solar open access, an increase of 92% compared to the 1.3 GW installed in 2021. This was the highest record of annual installations, according to the newly released report: 2022 Q4 & Annual Mercom India Solar Open Access Market Report.

Installations reached an all-time high in 2022 as various organizations and developers rushed to finish projects before Basic Customs Duty (BCD) and Approved List of Models and Manufacturers (ALMM) regulations were enacted. Commissioning of projects delayed during the COVID-19 pandemic also added to the total.

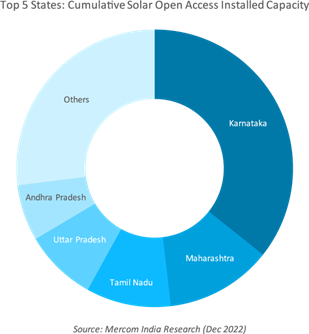

In 2022, Karnataka added the most solar open access capacity, followed by Maharashtra and Tamil Nadu. The top five states comprised 77% of total installations during the year.

India added 293 MW of solar open access capacity in Q4 2022, down 52% quarter-over-quarter (QoQ) compared to 615 MW installed in Q3 2022. Quarterly installations were down almost 10% year-over-year (YoY).

The top five states contributed over 96% of all open access installations in Q4 2022. Karnataka remained the leading state, accounting for over 32% of capacity addition in the quarter.

As of December 2022, the cumulative installed solar open access capacity reached 7.7 GW.

The development pipeline of solar open access projects in the country was 6.6 GW as of Q4 2022 – almost 70% of the pipeline was spread across – Andhra Pradesh, Rajasthan, Karnataka, Maharashtra, and Gujarat.

As of December 2022, Karnataka remained the top state, accounting for almost 36% of cumulative solar open access capacity. Maharashtra followed, making up over 12% of the total installations.

In short-term markets, Andhra Pradesh was the largest electricity supplier in the Green Day-Ahead Market (G-DAM), accounting for over 40% of the market in Q3 2022.

Gujarat became the leading energy procurer from G-DAM, followed by Maharashtra, representing 14.6% and 12.5%, respectively, of the total power purchased in Q3 2022.

During Q4, the Delhi High Court suspended trading of renewable energy certificates issued before October 31, 2022, for six weeks, adversely impacting trading.

“Solar installations in the open access segment outpaced regulatory challenges and recorded the best year-to-date, despite the odds. Overwhelming growth reflects demand by the industries and commercial units keen on sourcing clean power and capitalizing on the economic benefits. Though the government has announced that consumers with a sanctioned load of 100 kW or more are eligible to source green power through open access, consumers below 1 MW demand remain largely underserved and an untapped market,” commented Priya Sanjay, Managing Director at Mercom India.

The report offers a detailed analysis of the solar open access segment in seventeen states, including open access charges, retail supply tariffs, and market size.

The average PPA prices, net landed costs, banking regulations, short-term transactions, and open access policies and regulations released in Q4 2022 are also featured in the report.

The report also highlights the views and opinions of the top open access installers nationwide during the quarter.

Key Highlights from Mercom India Research’s 2022 Q4& Annual India Solar Open Access Market Report

In 2022, India added about 2.5 GW of solar open access, a YoY increase of 92%

In Q4, 293 MW of solar open access was added, down 52% QoQ and almost 10% YoY

Karnataka was the leading state, with 94 MW added in Q4 2022

Tamil Nadu and Maharashtra ranked second and third making up around 22% and 21% of total installations in Q4 of 2022

As of December 2022, the total installed solar open access capacity was over 7.7 GW

The top five states account for 73% of cumulative solar open access installations

The pipeline of solar open access projects was over 6.6 GW

The “2022 Q4 & Annual Mercom India Solar Open Access Market Report” report is 79 pages and covers vital information and data on the market. For the complete report, visit: https://mercomindia.com/product/india-solar-open-access-market-report-q4-2022/